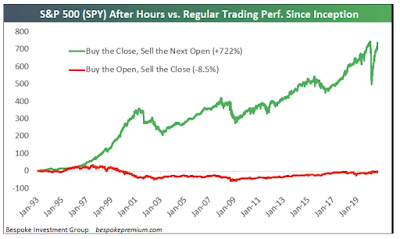

This is a follow up to my earlier blog post on the subject a few days ago. To remind ourselves, our starting point was the following chart from the Bespoke Investment Group that indicated that the entire accrued value of the S&P 500 since 1992 was captured by After Hours traders (who bought the S&P 500 after the Close the previous day and sold it at the Open on the following day), and that the "during regular hours traders" (who bought the S&P 500 at the Open and sold it at the Close of the market on a daily basis), did not capture any of the upward movement in the S&P 500 since 1992.

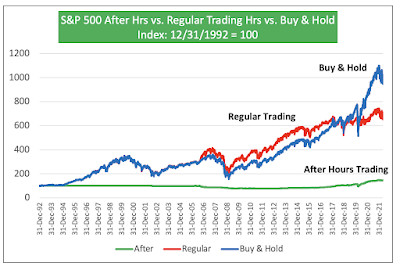

At the time, I was skeptical that the After Hours traders would reap 100% or more of the gains in the S&P 500. And, I replicated this graph using data from Yahoo Finance. And, I uncovered that the Bespoke Investment Group (BIG) simply confused one variable for another. And, after making the appropriate correction, the World still made sense. And, contrary to what BIG disclosed, the vast majority of the gains were actually captured to the traders during market hours as one would expect as shown on my chart below.

Readers of the first blog post on the subject a few days ago invited me to give the data a second and more detailed look at the data. When I did that, I uncovered that there is a divergent period from September 2016 to the present, when the majority of the gains actually do flow to the After Hours traders. And, the chart below reflecting this visual data looks very similar to the original BIG chart (but using a truncated time period).

In the chart above, over the reviewed period, even after using accurate data the vast majority of the gains in the S&P 500 do accrue to the After Hours traders. I find that rather dismaying. And, after doing a bit of research based on hypotheses generated by readers, I could find an explanation. There are a lot of breaking news during the After Hours period. Companies are allowed to release quarterly earnings after the market Close and before the market Open. Similarly, the majority of economic indicators releases are disclosed by the Government before the market Open. Given that, it makes much sense that the After Hours traders would reap the gains.

Now, is the market rigged? I find this question really uncomfortable because I find it rather challenging to answer this question in the negative. The timing of breaking news disclosure favors the large institutional investors over the retail investors that trade mainly during regular trading hours.

However, I have no explanation why this phenomenon (advantage of institutional investors trading After Hours) kicked in only since September 2016.

Yet, I am concerned that once this advantage has been captured by institutional investors, it will propagate going forward forever.

On the other hand, I am still comforted that a simple Buy & Hold strategy still performs a lot better than the daily After Hours strategy, as shown on the chart below.

The simple Buy & Hold strategy holds several "efficient" advantages over the After Hours trading, including:

1) Operating efficiency. Buy & Hold foregoes having to make 506 trades a year (253 trading days times 2 trades per day);

2) Buy & Hold value accretion is not impaired by bid-ask spreads. The latter materially affects the After Hours traders' value accretion, that is not shown on this graph (absence of data); and

3) Tax efficiency. The After Hours traders gains are 100% taxable as ordinary income. The Buy & Hold traders have unrealized capital gains that are not taxable. And, they will be taxable only when realized at much lower capital gains tax rates.

More often than not, the Buy & Hold strategy over a long period of time will perform better than After Hours trading; that is because Buy & Hold gains = After Trading Hours gains + Regular Hours gains + compounding effect. For instance, since September of 2016, when After Trading Hours performed well, it captured 80% of the gains of the Buy & Hold strategy. During Regular Hours trading captured 10%. And, the compounding effect captured the remaining 10%.